Breakthrough Victoria (BV) is reshaping Victoria’s innovation landscape, with a new independent EY report* estimating BV companies will generate up to $5.3 billion in additional economic activity by 2035.

With 69 investment commitments totalling committed capital of $480 million, BV is Victoria’s largest and most active venture capital fund. Investing across companies, funds, University partnerships, fellowships, and via one grant, there is not an investment lever in the VC ecosystem BV has not pulled.

The government-owned VC’s distinctive co-investment model attracts an average of 7.7 private investors per deal, and has already mobilized $1.3 billion in combined co-investment of public and private capital alongside BV — on par with much longer-established global VC programs in countries like Finland, Ireland, and Taiwan.

Despite a challenging global investment climate over the last 12-24 months, BV has delivered an estimated internal rate of return (IRR) of 2.8% since inception. This early-stage performance surpasses the ASX Small Ordinaries as well as rivals’ returns seen in the US and EU markets. Substantially higher returns are expected in the future.

Positive net economic returns to public investment in BV are anticipated to begin flowing as early as 2026 to 2028, depending on how quickly BV’s portfolio companies scale.

BV is also playing a pivotal role in helping early-stage ventures overcome the “valley of death” in commercialising research and intellectual property. With 83 per cent of its portfolio companies already exporting or planning to export, and 79 patent applications filed since 2022, BV is accelerating Victoria’s shift towards a knowledge-based, innovation-driven economy.

As it continues to deploy capital across five priority sectors, BV is poised to deliver both economic and social returns, solidifying its position as a cornerstone of Victoria’s innovation future.

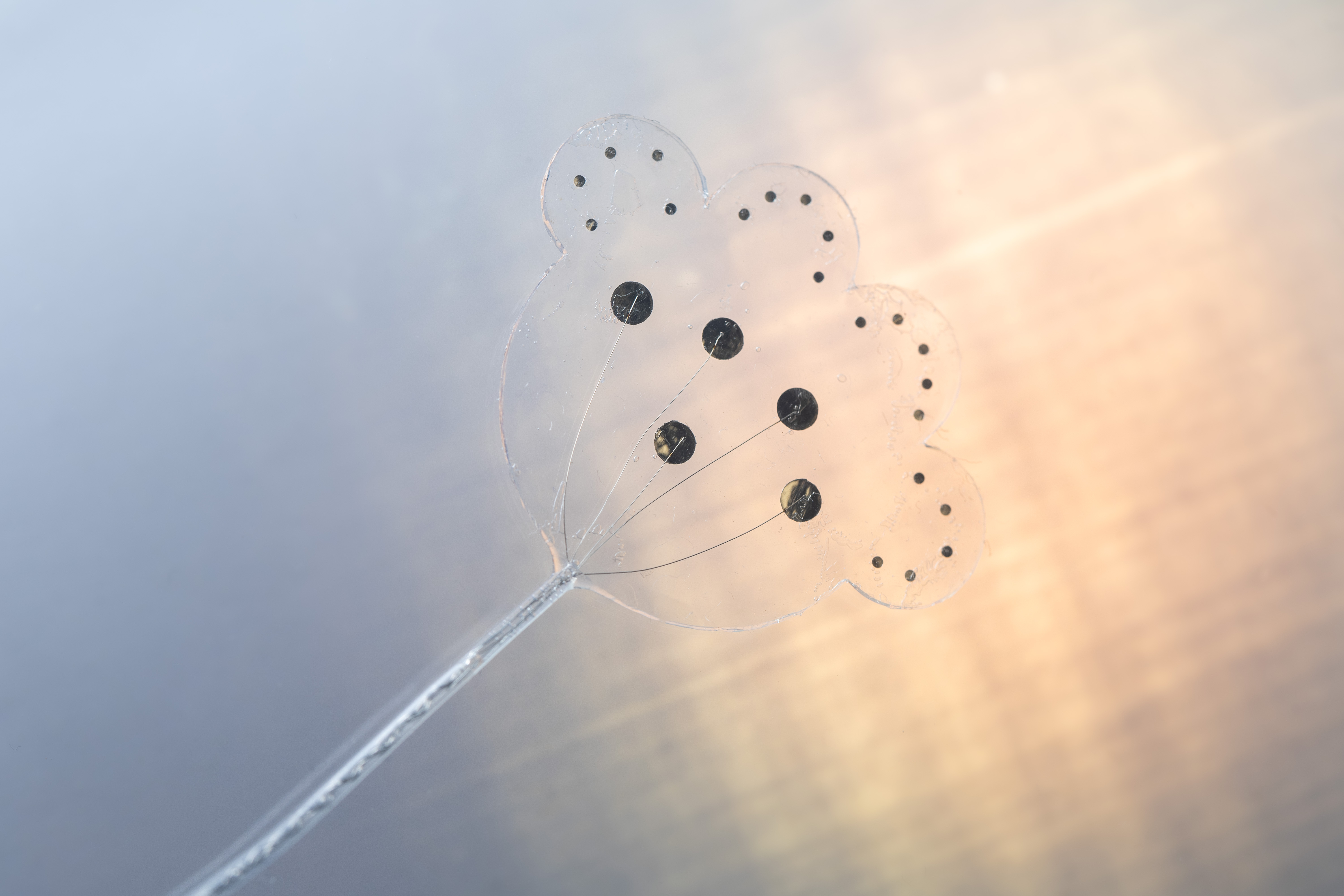

Image Credit: BV Portfolio Company Neo-Bionica

*EY Parthenon (2025) Fostering the innovation ecosystem: the economic impacts of Breakthrough Victoria’s portfolio