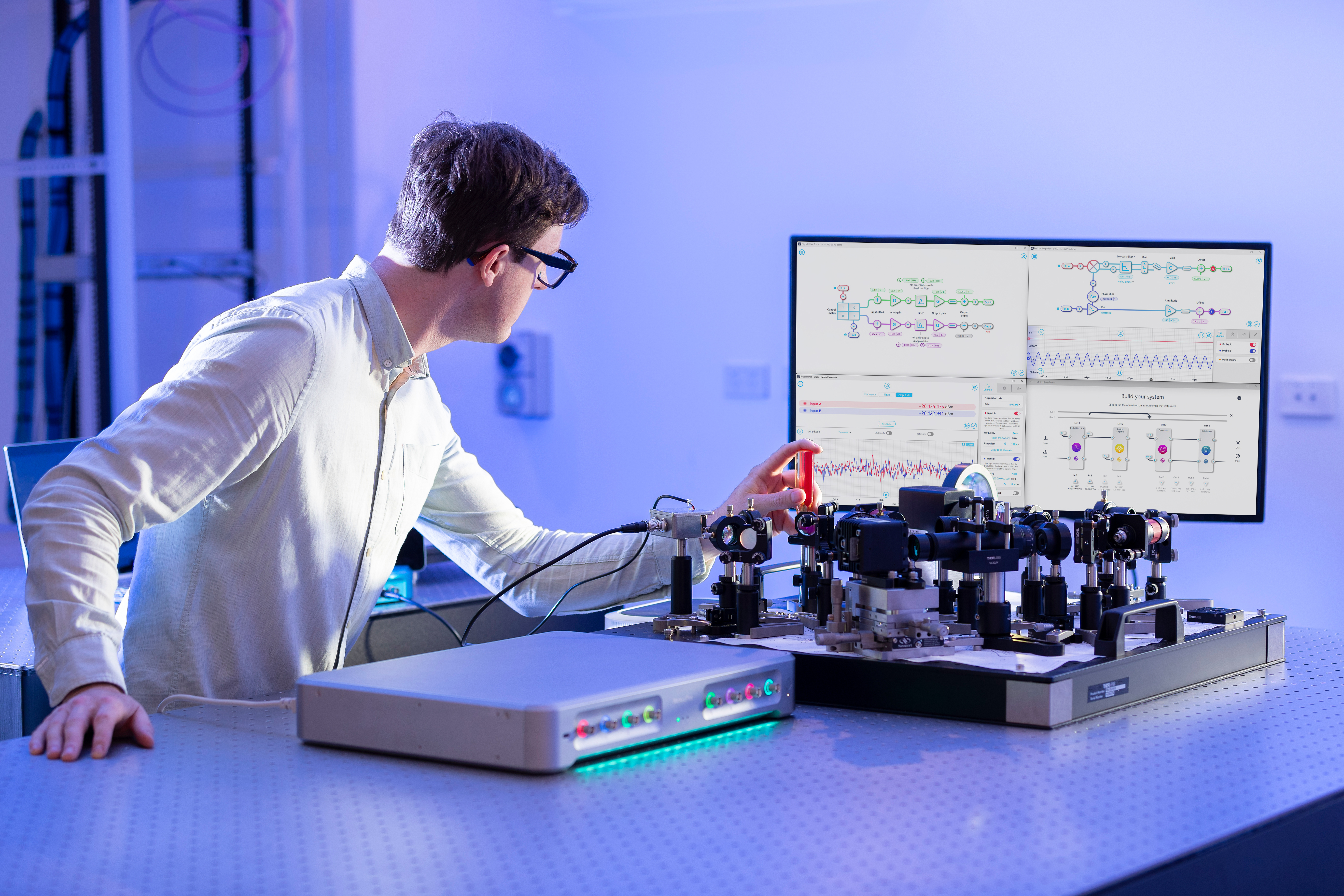

Image credit: BV portfolio company Liquid Instruments

By Rod Bristow, CEO of Breakthrough Victoria

At Breakthrough Victoria our vision is clear: Transforming the Victorian economy by investing in and supporting successful IP and research commercialisation.

We deliver this vision by investing in innovation and technology commercialisation and catalysing private investment to deliver economic growth, job creation and environmental and social impact for Victoria.

Now an independent report by EY* has confirmed our core belief—Breakthrough Victoria is not only delivering strong financial returns but also generating transformative economic and social impact across the state.

We’ve committed over $480 million to 69 investments, and in doing so, we’ve become the largest and most active venture capital fund based in Victoria. But our success isn’t just measured in dollars invested—it’s in the $1.3billion in total capital co-investment we’ve helped unlock, the 7.7 co-investors per deal we’ve attracted, and the global benchmarks we’re now matching in terms of scale and sophistication.

Building a Resilient Innovation Ecosystem

Our portfolio spans five priority sectors—advanced manufacturing, digital technologies, clean economy, health and life sciences, and agrifood. These are not just industries of the future; they are the engines of productivity, sustainability, and global competitiveness.

By 2035, EY projects our portfolio companies will generate up to $5.3 billion in additional economic activity by 2035.

This figure reflects more than economic growth—it represents the emergence of a dynamic, knowledge-driven economy that is creating jobs, exporting innovation, and attracting global attention.

Strategic, and Impactful

In a global VC environment marked by caution and contraction, Breakthrough Victoria has delivered an IRR of 2.8%, outperforming many private VC benchmarks and the ASX Small Ordinaries Index over the same period.

Looking Ahead

Breakthrough Victoria is more than a fund—it’s a platform for economic transformation through innovation. We help businesses navigate the “valley of death” in commercialisation, support patent development, and enable export growth. With 83% of our portfolio companies exporting or planning to export, and 79 patent applications filed since 2022, through direct investment, our University Innovation Platform, the Jumar Bioincubator and our fund investments, we are laying the groundwork for a globally competitive innovation economy.

As we continue to deploy capital, our focus remains on unlocking potential, driving productivity, and ensuring that Victoria remains at the forefront of technological and economic progress.

Breakthrough Victoria is not just investing in companies—we’re investing in the future of Victoria.

About the author: Rod has 30 years’ experience encompassing the stockbroking, asset management, wealth management, agribusiness and not-for-profit sectors.

His previous roles include CEO of Sydney and Singapore-based VC firm Investible, ICEO of ASX-listed Clime Investment Management Limited, MD of Infocus Wealth Management Ltd, CEO of environmental NGO Greening Australia and Chief Operating Officer and alternate MD of Australia’s largest retail stockbroker, CommSec. He also cofounded a business in the environmental management and carbon offsets space, and his career has been defined by a deep commitment to the intersection of capital and impact.

*EY Parthenon (2025) Fostering the innovation ecosystem: the economic impacts of Breakthrough Victoria’s portfolio